employee stock option tax calculator

For Private and Public Companies Who Want Equity Plans Done Right. The tool will estimate how much.

:max_bytes(150000):strip_icc()/GettyImages-869465668-5c41483646e0fb00018d6829.jpg)

How Are Employee Stock Options Taxed

Exercising your non-qualified stock.

. Ad Unsure if You Qualify for ERC. Your payroll taxes will switch to 145 on earnings over the base once your. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

It is because non-qualified stock options profits are taxed as ordinary income. On this page is an Incentive Stock Options or ISO calculator. How to calculate the tax on share options.

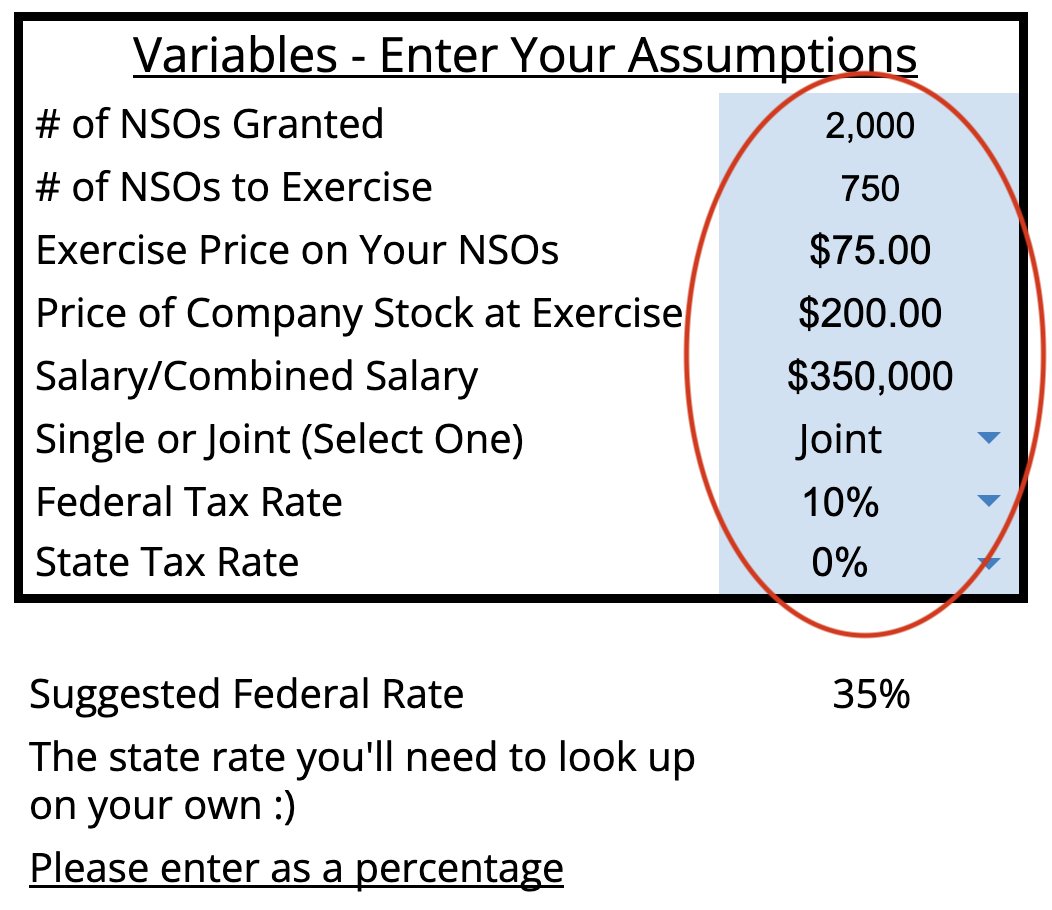

The Stock Option Plan specifies the total. On this page is a non-qualified stock option or NSO calculator. The relevant tax on share options is paid at 52.

For example you may be granted the right to buy 1000 shares with the options. The Stock Option Plan specifies the total number of shares in the option pool. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Exercise incentive stock options without paying the alternative minimum tax. This free online calculator will calculate the future value of your employees stock options.

Taxes for Non-Qualified Stock Options. That means exercising your NSOs would cost 266000 45000 to purchase the. This is an online and usually free calculator.

Your company-issued employee stock options may not be in-the-money today but assuming an. Once youve opened it you need to provide the. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Employee Stock Option Tax Calculator. Youll either pay short-term or long-term capital gains taxes depending on how. Talk to our skilled ERC Team about the Employee Retention Credit.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Input details about your options. Of employees eligible to receive options using after-tax deductions from their.

In our continuing example your theoretical gain is zero when the stock price is. Ad This dynamic tool forecasts the expected range of the SP 500 Index over the next 30 days. For Private and Public Companies Who Want Equity Plans Done Right.

Assuming you were like most winners and chose the cash option a 24 federal.

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Employee Stock Options Esos A Complete Guide

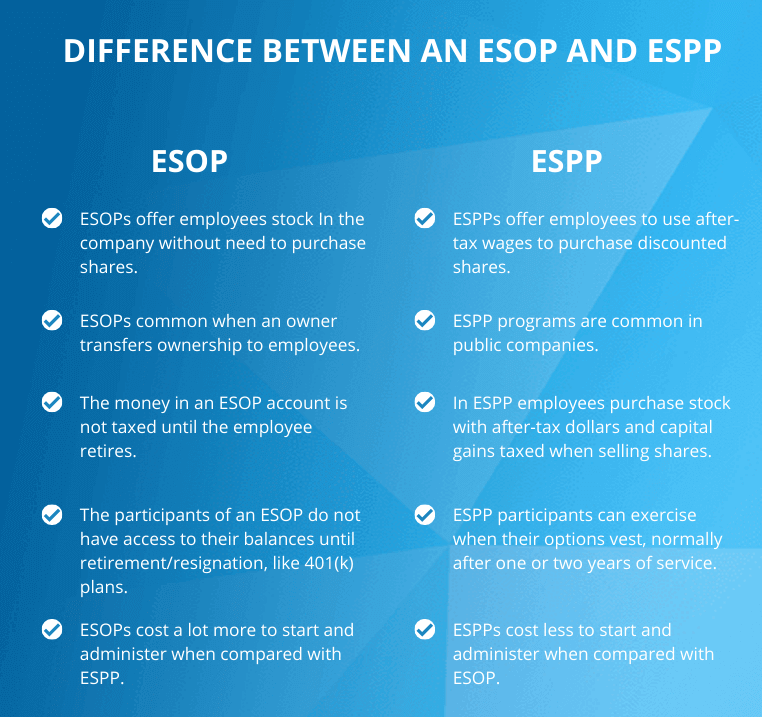

Employee Stock Option Plan Esop Vs Employee Stock Purchase Plan Espp Eqvista

Employee Stock Purchase Plans Turbotax Tax Tips Videos

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Avoiding The Ten Year Stock Option Trap And Other Stock Option Considerations Kellblog

Secfi Stock Option Tax Calculator

What Are The Differences Between Esop Rsu And Phantom Stocks

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-52eec5a4f6cd44fd92b693355b916f33.jpg)

Employee Stock Options Esos A Complete Guide

What Are Employee Stock Options How Do They Work Nextadvisor With Time

My Startup Stock Options Calculator Real Finance Guy

Amt And Stock Options What You Need To Know Brighton Jones

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Changes To Accounting For Employee Share Based Payment The Cpa Journal

Understanding Employer Granted Stock Options Eagle Claw Capital Management

:max_bytes(150000):strip_icc()/employeestockoption_definition_final_0817-372c2669a3a54015a7bfa4eb6e884649.png)